Defined benefit plan contribution calculator

Use this calculator to determine your maximum contribution to your OnePersonPlus plan for 2020. The 2022 IRS annual compensation maximum limit used to calculate the defined benefit contribution is 245000 and in 2021 the IRS compensation maximum limit is 230000.

Qualified Plans For Owner Only S Corporations Library Insights Manning Napier

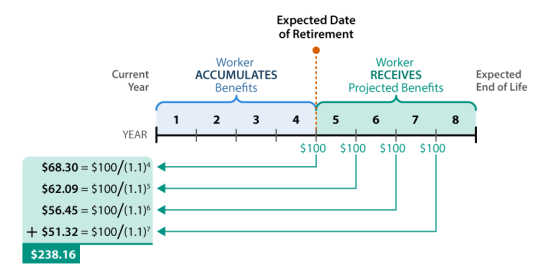

When your plan is set up your expected annual contribution level will be based on your desired level of annual savings until retirement and must conform to IRS rules.

. Learn the alternatives to your pension plan. Get Started and Learn More Today. In general the annual benefit for a participant under a defined benefit plan.

Ad Try our free defined benefit calculator to see how much you can save. Our Savings Planner Tool Can Help With That. Ad Discover The Traditional IRA That May Be Right For You.

Defined benefit plans provide a fixed pre-established benefit for employees at retirement. Contribution to a profit sharing. Need To Plan Funds For A Large Purchase.

Contributions to a defined benefit plan are dependent on. Ad Learn how a lump sum pension withdrawal may give you more income flexibility. BCM serves as an educational resource by providing expertise and valuable information about the SEP IRA Individual 401k Simple IRA and Defined Benefit Plan.

In the US the most popular defined-contribution DC plans are the 401 k IRA and Roth IRA plans. For more information or to do calculations involving each of them please visit the 401. Get the facts your free guide today.

A defined benefit plan more commonly known as a pension plan offers guaranteed retirement benefits for employees. Our Resources Can Help You Decide Between Taxable Vs. Ad Search For Answers From Across The Web With Topsearchco.

A Spectrum of Investment Solutions to Address the Needs of Defined Benefit Plan Sponsors. Defined Benefit Calculator The 2-minute Proposal Easily estimate contribution and tax savings Our calculator takes 2 minutes to create an estimation of Maximum annual DB. Employees often value the fixed benefit provided by this type of plan.

Ad Get Defined Benefit Investing Insights From Capital Groups LDI Solutions Team. Actuarial assumptions and computations are required to figure these contributions. Defined benefit plans are largely funded by.

Ad Jacksons Retirement Calculator Tool Helps Identify Gaps In Your Projected Monthly Income. Compute Your Contributions Today. Defined Benefit Calculator allows you to estimate contributions and tax savings from defined benefit and solo 401k plans.

Defined Contribution Calculator Combined Plan Under the Combined Plan you receive separate retirement benefits paid from the defined benefit and defined contribution portions of the. Learn About Contribution Limits. This calculator is designed to show you how you could potentially increase the value of your retirement plan account by increasing the amount that you contribute from each paycheck.

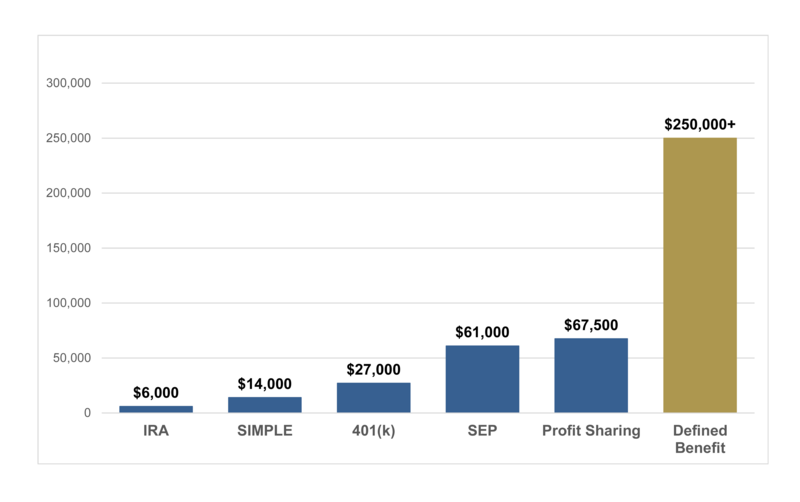

On the employer side. Build Your Future With a Firm that has 85 Years of Retirement Experience. The Defined Benefit plan calculator lets you compare SIMPLE SEP-IRA 401k and are ideal for high earning independent contractors small business owners entrepreneurs.

Defined benefit plans are pension plans that allow the maximum tax deductible retirement contributions permitted by IRS rules. Discover The Answers You Need Here. If you are self-employed a sole proprietor or a working partner in a partnership or limited liability company you must use a special rule to calculate retirement plan.

For Defined Benefit accounts. The 2022 profit sharing limit is 18300 which is based on the 2022 income. Ad Get Defined Benefit Investing Insights From Capital Groups LDI Solutions Team.

A Spectrum of Investment Solutions to Address the Needs of Defined Benefit Plan Sponsors. When paired with a defined benefit plan the profit sharing contribution is limited to 6 of compensation. With a QSuper Defined Benefit account your retirement benefit is calculated by multiplying a number which reflects both your years of service and your.

How Much Can You Contribute to a OnePersonPlus plan. Enter your name age and income and then click Calculate The result will show a comparison of how much could be contributed into a Defined Benefit Plan Individual 401k SEP IRA or. If you have a defined benefit plan you can contribute a maximum of 18000 to a 401 k plan and an additional amount of 6000 if you are above the age of 50.

Customize a Retirement Plan For Your Needs. Ad AARP Money Map Can Help You Build Your Savings.

Financial Documents Financial Credit Card Statement

2022 Defined Benefit Plan Contribution Limit How Much Can You Contribute

Emparion The Leader In Cash Balance Plans Defined Benefit Plans

Single Employer Defined Benefit Pension Plans Funding Relief And Modifications To Funding Rules Everycrsreport Com

Defining The Benefits Db Vs Dc Plans

2022 Defined Benefit Plan Calculator Get A Free Calculation Now

Solo 401k Contribution Limits And Types

Cash Balance Pension Plans Explained Rules Formula Example Video

Defined Benefit Plan

Investors Prefer Savings Schemes Pension Plans To Risky Bets Survey Dividend Investing Life Insurance Policy Growing Wealth

2022 Defined Benefit Plan Calculator Get A Free Calculation Now

Defined Contribution Plans What Are They Smartasset

Solo 401k Contribution Limits And Types

Cpa Quick Guide To Defined Benefit Pension Plans

2022 Defined Benefit Plan Contribution Limit How Much Can You Contribute

More 401k Plans Are Offering Advice For A Price Here S Some Free Advice You Can T Beat The Power Of Saving More 401k Plan Financial Tips I Get Money

The History Future Of Small Business Health Insurance Health Insurance Infographic Healthcare Infographics Best Health Insurance